Trust Administration

We assist successor trustees managing private trusts outside of probate. Our services include advising them on their obligations, preparing accountings, and drafting necessary notices and communications for beneficiaries.

Call our office and schedule your initial in-person or virtual consultation.

What are the Duties of a Trustee?

Administering the Trust

Administering a trust involves managing the trust's assets in accordance with the terms set forth by the trust creator, ensuring that the beneficiaries' interests are prioritized. This process includes making timely distributions, maintaining clear records, and adhering to legal and tax obligations.

Communication with Beneficiaries

Effective communication with beneficiaries during trust administration is crucial for building trust and transparency. Regular updates regarding asset management, distribution timelines, and any changes to the trust can help alleviate concerns and ensure that beneficiaries feel informed and engaged throughout the process.

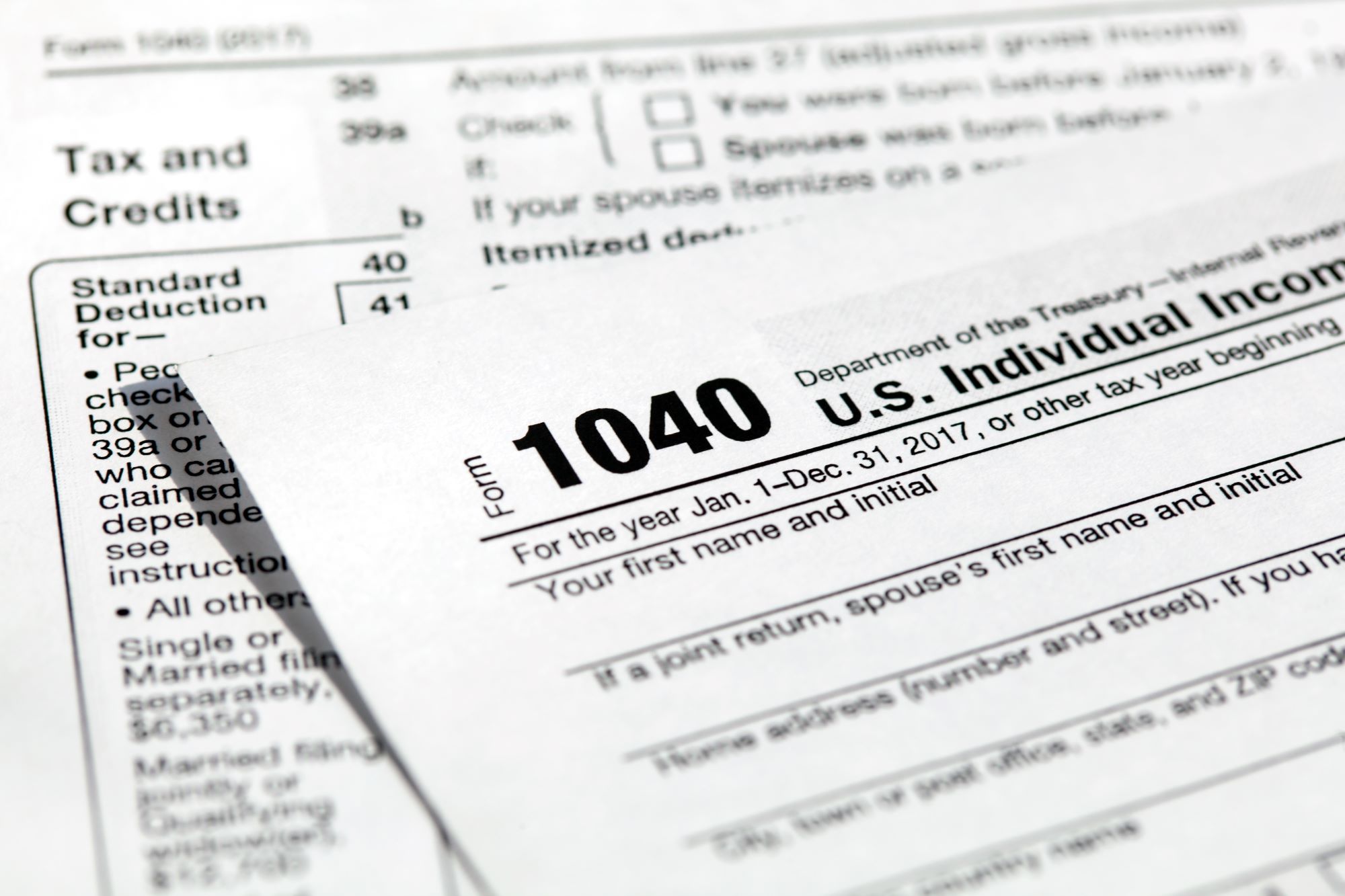

Accounting of the Trust

In trust administration, managing taxes and maintaining accurate accountings are essential responsibilities for the trustee. This includes filing any required tax returns for the trust, tracking income and expenses, and providing beneficiaries with detailed accountings to ensure transparency and compliance with legal obligations.